NEW PSAK [EFFECTIVE JAN 1, 2020]

There are some changes in PSAK in Indonesia that may major impact in following years

- PSAK 71 : Financial Instruments

- PSAK 72 : Revenue from Contracts with Customers

- PSAK 73 : Leases

Effective Date

- These statements effective immediately on Jan 1, 2020.

- Full retrospectives or modified retrospectives

PSAK 71

FINANCIAL INSTRUMENTS

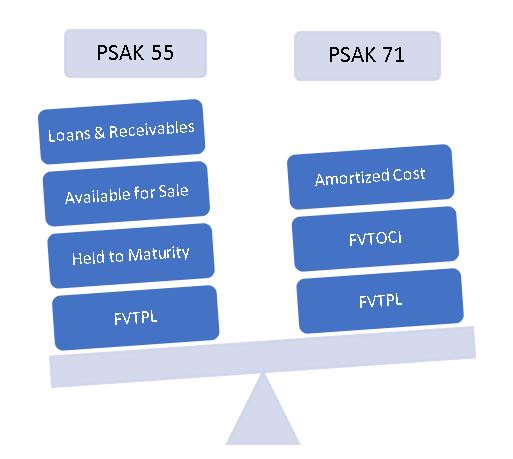

Adoption from IFRS 9 : Financial Instruments, replacing PSAK 55.

1. Classification

Four classification in PSAK 55 changed to three classification in PSAK 71. These classifications will be tested by SPPI and Business Model.

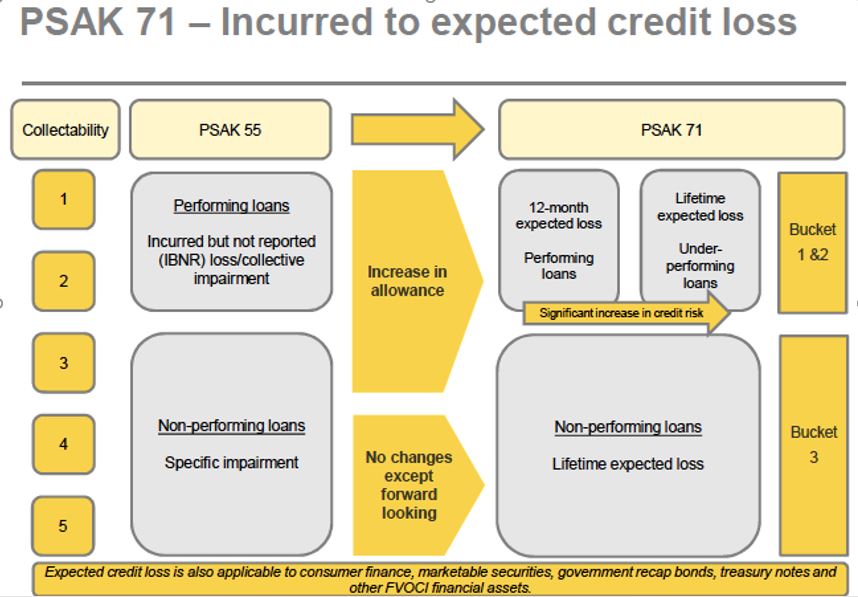

2. Impairment

Incurred Loss Model —> Expected Loss Model

3. Hedge

Hedge accounting under PSAK 55 was criticized for being: Complex, Rules based, Not aligned with risk management practices.

Objective of new hedge accounting model in PSAK 71: Represent in the financial statements the effect of an entity’s risk management activities.

PSAK 72

REVENUE FROM CONTRACTS WITH CUSTOMERS

Adoption from IFRS 15 : Revenue from Contracts with Customers, replacing PSAK 23.

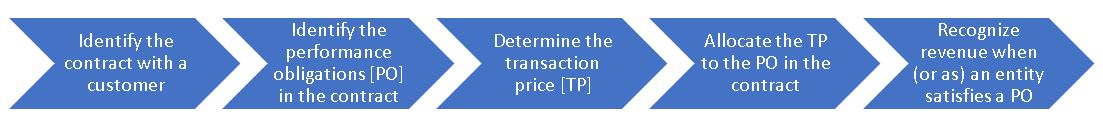

5-step model for revenue recognition

Identify the contract

- Parties have approved the contract and are committed to perform

- Each party’s rights to goods/services can be identified

- The payment terms for goods/services can be identified

- The contract has ecommercial substance

- It is probable that an entity will collect the consideration

Identify the PO

Promise in a contract with a customer to transfer to the customer either:

- Good/service that is distinct

- Series of distinct goods/services that are substantially the same and have the same pattern of transfer

Determine TP

- Amount of consideration to which the entity expects to be entitled in exchange for transferring promised goods/services to a customer excluding the amounts collected on behalf of third parties.

- Variable consideration

- Constraining estimates in variable consideration

- Existence of significant financing component

- Non-cash consideration

Allocate TP

- To allocate the TP to each PO in an amount that depicts the amount the consideration for transferring promised goods/services

- Based on relative stand-alone selling prices

- The price at which the entity would sell promised goods/services separately to the customer

Recognize revenue

PO is satisfied when a promised good/service is transferred to a customer

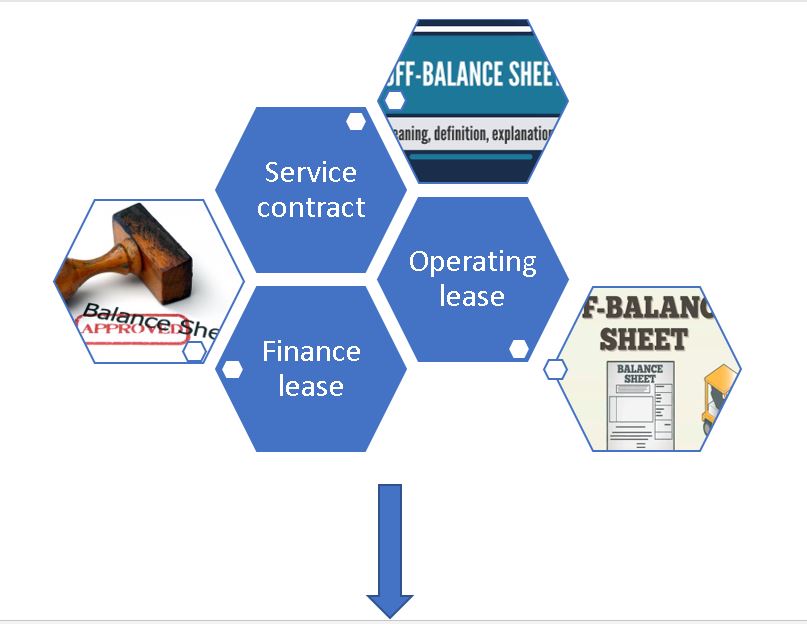

PSAK 73

Leases

Adoption from IFRS 16 : Leases, replacing PSAK 30.